Case study:

I was recently asked to advise a medium sized organisation on how to set up an agile risk management process. Although many of the risks were known intuitively, there was no formal list of risks and no analysis of possible mitigations or controls around these risks.

The result was a focus on a number of minor risks that just happened to get a lot of noise from some parts of the organisation. In just three sessions with senior management and the board we were able to understand the potential risks and prioritise them based on how likely they were to seriously harm the organisation.

We were also able to consider what was practicable and feasible in terms of protecting the organisation from those risks. It enabled the team to have confidence we were addressing the key ones and gave them increased assurance to pursue further opportunities. The feedback from the team was along the lines of: ‘that was a lot more straight forward and less bureaucratic than other options we had looked at’.

Risk Profile: Summary

- Risk is good – it’s linked to opportunity and reward

- Managing risk is important for survival and growth

- Managing risk need not be overwhelming

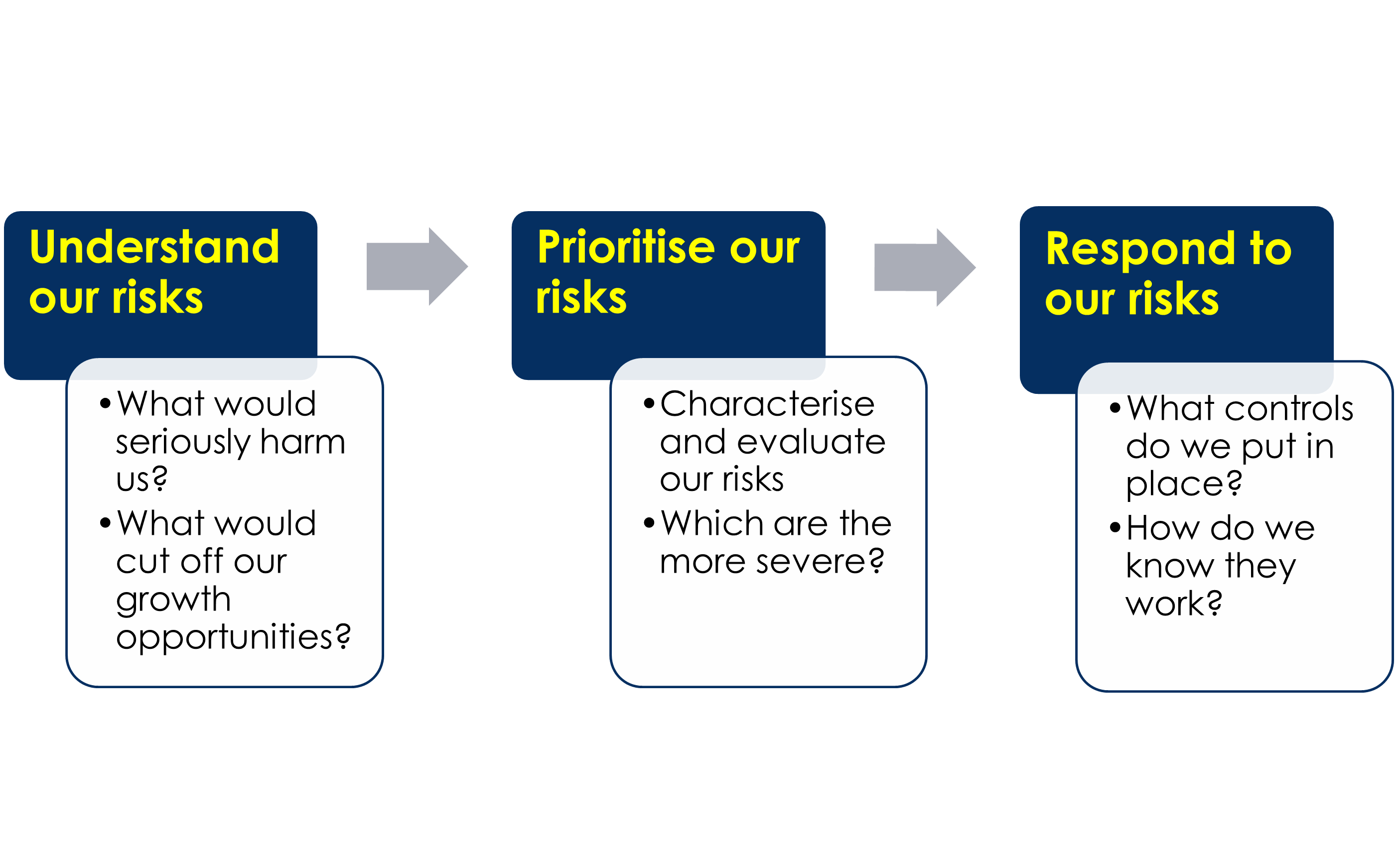

- A simplified approach to managing risk is important for smaller businesses – 3 key steps

- Get started!

Example

Jimmy owns a transport business. He drives trucks, moving commercial products around Australia. Some of the hazards Jimmy faces each day include:

- contact with chemicals and fumes when refuelling

- uncomfortable seating and fatigue, especially on long journeys

- no heating or air-conditioning to change the temperature inside the truck.

Some steps Jimmy could take to reduce the risks in his daily work include:

- wearing appropriate clothing to reduce his exposure to chemicals

- taking regular breaks during his trips to stretch and walk around

- ensuring that he only works the legal hours for his industry to deal with fatigue

- installing fans or air-conditioning in his truck

- having suitable clothing and water for each trip.

A simple three-step process to risk management

Leave A Comment